The 10-Minute Rule for Paul B Insurance

Wiki Article

Indicators on Paul B Insurance You Should Know

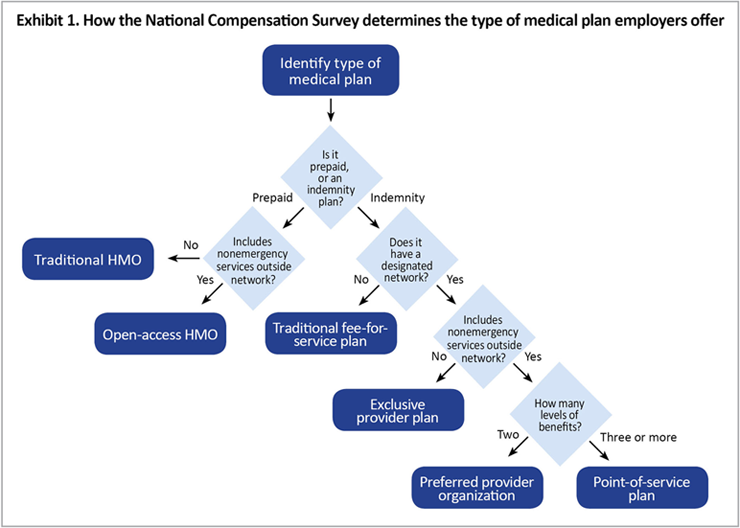

Relevant Topics One reason insurance concerns can be so confounding is that the health care market is constantly altering and also the coverage intends provided by insurers are difficult to categorize. To put it simply, the lines between HMOs, PPOs, POSs and also various other sorts of protection are often blurry. Still, comprehending the make-up of numerous plan types will certainly be handy in assessing your alternatives.

PPOs generally provide a broader option of suppliers than HMOs. Premiums may be comparable to or somewhat more than HMOs, and also out-of-pocket prices are generally higher and more difficult than those for HMOs. PPOs enable participants to venture out of the carrier network at their discernment and do not call for a recommendation from a health care doctor.

As soon as the deductible quantity is reached, additional wellness expenses are covered in conformity with the stipulations of the medical insurance policy. For instance, an employee may then be in charge of 10% of the costs for treatment obtained from a PPO network company. Down payments made to an HSA are tax-free to the company and employee, as well as money not invested at the end of the year might be surrendered to pay for future medical expenses.

Facts About Paul B Insurance Uncovered

(Company payments have to be the very same for all staff members.) Workers would be accountable for the first $5,000 in medical costs, but they would each have $3,000 in their personal HSA to spend for clinical costs (as well as would have much more if they, also, added to the HSA). If employees or their households tire their $3,000 HSA allocation, they would pay the next $2,000 expense, whereupon the insurance coverage plan would begin to pay.

(Certain limitations might put on very compensated participants.) An HRA needs to be funded entirely by an employer. There is no limit on the quantity of money an employer can contribute to staff member accounts, nonetheless, the accounts may not be funded with employee wage deferrals under a lunchroom plan. Additionally, companies are not allowed to refund any kind of component of the equilibrium to workers.

Do you recognize when the most remarkable time of the year is? The wonderful time of year when you obtain to compare health and wellness insurance plans to see which one is ideal for you! Okay, you got us.

4 Simple Techniques For Paul B Insurance

But when it's time to choose, it's important to understand what each plan covers, how much it sets you back, as well as where you can use it, right? This things can really feel challenging, but it's much easier than it appears. We assembled some sensible learning steps to help you feel confident about your options.

(See what we did there?) Emergency care is typically the exception to the guideline. These plans are one of the most preferred for individuals that obtain their health and wellness insurance coverage through work, with 47% of protected employees signed up in a PPO.2 Pro: A Lot Of PPOs have a decent choice of suppliers to pick from in your location.

Con: Greater costs make PPOs much more expensive than various other kinds of plans like HMOs. A health upkeep organization is a wellness insurance policy plan that usually just covers care from physicians who help (or contract with) that specific strategy.3 Unless there's an emergency, your strategy will not pay for out-of-network treatment.

The Basic Principles Of Paul B Insurance

Even More like Michael Phelps. The plans are tiered according to just how much they set you back as well as what they cover: Bronze, Silver, Gold as well as Platinum. (Okay, it holds true: The Cre did have some platinum records and Michael Phelps never won a platinum medal at the Olympics.) Trick fact: If you're eligible for "cost-sharing decreases" under the Affordable Treatment Act, you should select a Silver plan or far better to obtain those decreases.4 It's good to know that strategies in every classification give some kinds of complimentary preventive care, and some deal free or affordable healthcare services before you fulfill your deductible.

Bronze plans have the most affordable regular monthly costs yet the highest possible out-of-pocket prices. As you function your means up through the Silver, Gold and Platinum categories, you pay a lot more in premiums, but much less in deductibles and coinsurance. However as we mentioned previously, the extra expenses in the Silver classification can be lessened if you get the cost-sharing decreases.

Decreases can reduce your out-of-pocket medical care sets you back a whole lot, so get with among our Supported Local Service Providers (ELPs) that can help you figure out what you may be eligible for. The table listed below shows the percentage that the insurance business paysand what you payfor covered expenditures after you satisfy your insurance deductible in each strategy classification.

Unknown Facts About Paul B Insurance

Other prices, frequently called "out-of-pocket" prices, can add up rapidly. Points like your deductible, your copay, your coinsurance amount and also your out-of-pocket optimum can have a huge effect on visit the complete expense. Right here are some costs to maintain close tabs on: Deductible the quantity you pay prior to your insurance provider pays anything (besides totally visit free preventative treatment) Copay a set quantity you pay each time for points like physician brows through or various other solutions Coinsurance - the percentage of medical care services you are in charge of paying after you've struck your deductible for the year Out-of-pocket optimum the yearly limitation of what you are accountable for paying on your very own Among the finest means to conserve cash on medical insurance is to try this web-site make use of a high-deductible health insurance (HDHP), specifically if you do not expect to on a regular basis make use of medical services.

These job rather a lot like the various other wellness insurance policy programs we defined currently, yet practically they're not a kind of insurance coverage.

If you're attempting the do it yourself course as well as have any lingering questions about medical insurance plans, the specialists are the ones to ask. And they'll do more than simply answer your questionsthey'll additionally locate you the ideal cost! Or perhaps you 'd like a means to incorporate obtaining excellent medical care protection with the chance to help others in a time of demand.

All about Paul B Insurance

CHM aids families share health care prices like medical tests, pregnancy, hospitalization and also surgery. Plus, they're a Ramsey, Relied on companion, so you know they'll cover the medical bills they're expected to and also recognize your protection.

Secret Inquiry 2 Among the important things healthcare reform has actually carried out in the U.S. (under the Affordable Treatment Act) is to present more standardization to insurance coverage strategy advantages. Prior to such standardization, the benefits supplied varied dramatically from strategy to strategy. For instance, some plans covered prescriptions, others did not.

Report this wiki page